Economics is the study of how people use resources to satisfy their needs and wants. It includes the study of how people allocate their time, energy, and money to produce, consume, and exchange goods and services. Economics also looks at how economies work and how they are affected by changes in government policy, technology, and other factors.

Then why does this matter to me? You might ask. Well it all boils down to personal finance. If you have decided to improve your finances and increase your future income or your savings, then this should interest you. In order to take better decisions regarding investing and your personal economy, you should read up and learn as much as possible about the events that might impact the economy. Whether it has an impact on your personal economy or the companies you invest in or the nation’s economy.

Top 10 finance movies you must watch

The world of finance has inspired some of the most thrilling movies, offering a fascinating window into the lives of traders, stockbrokers, and billionaires. Here’s a roundup of the top 10 finance movies that deliver entertainment, insight, and a taste of the high-stakes world of Wall Street and beyond. 1. Trading Places (1983) Directed by…

European Markets Attract Professionals More Than the USA

Strategists Overweight European Stocks Over the US for the First Half of 2024. “It’s More Than a Tactical View” This is according to Maximilian Uleer, Head of European Equity and Asset Strategy at Deutsche Bank, who spoke to CNBC’s “Squawk Box Europe.” The background to this positioning, he says, is a belief that Europe’s stock…

Relief Rallies Both in the US and Asia

The Federal Reserve’s announcement to leave interest rates unchanged for the third consecutive time and signal three rate cuts in 2024 triggered a rally in the US stock markets, and Asia didn’t want to be left behind. Hong Kong’s Hang Seng Index leads the rally in Asian stock markets on Thursday morning, although Australia’s leading…

The oil market is marked by anxiety ahead of 2024

The oil market may become volatile again next year, with widespread anxiety among investors in the ‘black gold’. Reuters reports that what concerns oil investors is a ‘gnawing worry about oversupply, slowing economic growth, and simmering tensions in the Middle East that could trigger price volatility.’ In 2022, when Russia invaded and started the war…

The ABC of Personal Finance

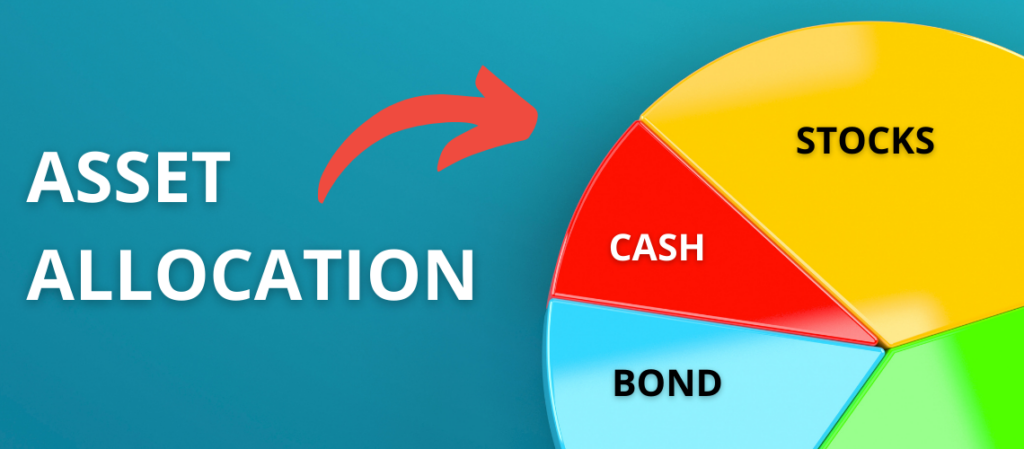

In personal finance, the ABCs are asset allocation, budgeting, and credit management.

Asset allocation is the process of dividing your assets among different investments to achieve your financial goals. There are three main asset classes: stocks, bonds, and cash. Each has different characteristics and risk levels.

Budgeting is creating a plan to track your income and expenses. It’s important to live within your means and save for both short-term and long-term goals.

Credit management is using credit wisely. This includes things like paying your bills on time, maintaining a good credit score, and not borrowing more than you can afford to repay.

Investing in Tech Stocks

Technology stocks are a broad category of stocks that relate to the research, development and/or production of technological goods and services. The sector includes computer hardware and software, semiconductors, telecommunications equipment, the internet and other technology-related products. Historically, the technology sector has been a high-growth industry. The sector has outperformed the broader market in 11…

Why Diversifying Your Investments is Important for Achieving Financial Goals

Achieving financial goals is important for everyone, but especially for those who are nearing retirement. Diversifying one’s investments is one of the most important keys to success. There are a number of reasons why diversifying your investments is so important. First, by spreading your money across a number of different investments, you are less likely…

The ABC of Investing

Investing can be a confusing and intimidating topic for many people. However, it doesn’t have to be! It can also be quite fun and exciting.

What is investing? Investing is simply putting your money into something with the expectation of earning a return on your investment. For example, you might invest in stocks, bonds, or real estate. Why invest? There are two main reasons to invest: to grow your wealth over time, and to generate income. Growing your wealth means that you’ll have more money saved up for retirement or other future goals. And generating income from investments can help you reach your financial goals sooner.